Manufacturing Momentum Shifts: ASEAN and India Are Emerging as Key Growth Engines for Taiwan’s Hydraulic and Equipment Suppliers

Under economic and geopolitical pressures that are reshaping global supply chains, Taiwanese suppliers are turning to emerging markets to secure new growth momentum.

The structure of Asian manufacturing is changing, not contracting

China’s Manufacturing PMI has stayed below 50 lately, signaling softer manufacturing conditions. For more than a decade, Taiwan’s industrial component suppliers have depended heavily on China for contract manufacturing and exports. As a result, fluctuations in China’s manufacturing climate have traditionally had a direct impact on Taiwan’s order volumes and investment sentiment.

However, this cycle presents a different pattern.

China’s economic slowdown is accelerating supply chain diversification, and rather than reducing demand for hydraulic and industrial equipment, it is driving stronger demand in ASEAN and India¹. Taiwanese manufacturers are increasingly tapping into these markets to capture opportunities created by production relocation, equipment modernization, and replacement needs.

To support this transition, Taiwan Machine Tool and Accessory Builder's Association commissioned Industry, Science & Technology International Strategy Center (ISTI) to release the report for India Market Landscape and Entry Strategies for Taiwan’s Machine Tool Industry, which outlines India’s industrial development and provides strategic guidance for Taiwanese manufacturers planning to enter the market.

ASEAN Is Evolving from a Secondary Option to a Core Market

Across ASEAN and India, genuine, long-term industrial growth is evident, which contrasts clearly with China’s current economic slowdown:

Vietnam: Electronics manufacturing expansion boosts demand for hydraulic fixtures and die-casting equipment.

Thailand: Tier-1/Tier-2² automotive suppliers are upgrading production capacity.

Malaysia: Semiconductor packaging and industrial park investments continue.

India: Strong growth in automotive, machining, agricultural machinery, and construction equipment.

Taiwanese hydraulic manufacturers stand out with short lead times, customization capability, and competitive pricing, which are becoming increasingly important as production relocates across Asia.

4 Reasons ASEAN and India Have Become Strategic Priorities for Taiwan

1. Real market growth, not merely a substitution for China

The hydraulic market in ASEAN and India is expanding faster than the Asia-Pacific average due to manufacturing relocation, rising domestic needs, infrastructure investment, and equipment modernization.

2. Strong demand for compatible replacement components

Many factories in the region operate older machinery and prefer easily replaceable, compatible hydraulic parts, generating substantial aftermarket demand.

3. Taiwan’s strengths in short lead times and engineered customization

Small-lot customization and rapid delivery are areas where Taiwan remains highly competitive versus Japanese and European suppliers.

4. Increasing need for supply chain diversification

As supply chain volatility rises, many ASEAN manufacturers view Taiwan as a reliable and stable sourcing partner, strengthening Taiwan’s role in regional procurement strategies.

CML as a Reliable Partner for Hydraulic Equipment Upgrades Across Southeast Asia

As ASEAN and India continue expanding their industrial capacity, CML offers a comprehensive portfolio of hydraulic pumps and systems across eight product categories, enabling:

- Flexible customization

- Legacy equipment parts replacement

- Specialized flow and pressure performance solutions

- Localized engineering and technical consultation

- Service coverage through partnered distributors in key ASEAN markets

With long-term cooperation from local distributors, CML is able to provide timely communication, regional support, and better availability of products and parts, ensuring that customers can access the solutions they need more efficiently. CML will continue deepening regional presence to support manufacturers as they expand their operations.

¹ASEAN and India, with 11 countries and nearly 2 billion people, are emerging as one of the world’s most dynamic industrial and consumer markets.

² Tier-1 and Tier-2 describe supply chain layers. Tier-1 suppliers provide components directly to automotive OEMs, while Tier-2 suppliers supply parts to Tier-1 rather than to OEMs directly.

Manufacturing Momentum Shifts: ASEAN and India Are Emerging as Key Growth Engines for Taiwan’s Hydraulic and Equipment Suppliers | Globally Certified Hydraulic Valves & Pumps – CML Wins 2024 REBRAND 100® Award

Located in Taiwan since 1981, Camel Precision Co., Ltd. is a hydraulic pumps and hydraulic valves manufacturer in Machinery and Equipment Manufacturing Industry.

In 1981 Camel Precision Co.,Ltd was founded. The management of company fully awards of high quality products requires not only sophisticate machinery, But good knowledge in technology is also important as well. Company invited senior engineers from Germany and Japan to lead the manufacturing and training of local engineers in hydraulic industry. We offer our customers industrial pumps, solenoid directional control valves, hydraulic pumps, vane pumps, external gear pump, internal gear pump, directional valve, hydraulic valves...etc.

CML, Camel Hydraulic, Camel Precision has been offering customers high-quality Vane Pump, Variable Displacement Vane Pump, Internal Gear Pump, Eckerle Asia Agent, External Gear Pump, Solenoid Valve, Modular Valve, Pressure Reducing Valve, Flow Control Valve, Hydraulic Valve since 1981, both with advanced technology and 38 years of experience, CML, Camel Hydraulic, Camel Precision ensures each customer's demands are met.

Company Facts in Numbers

0

Years of industry experience

0

Number of clients served

0%

Customer repurchase rate

Trending Now

With 40+ years of experience, CML excels in cross-border and cross-industry collaborations, developing energy-efficient solutions for a sustainable.

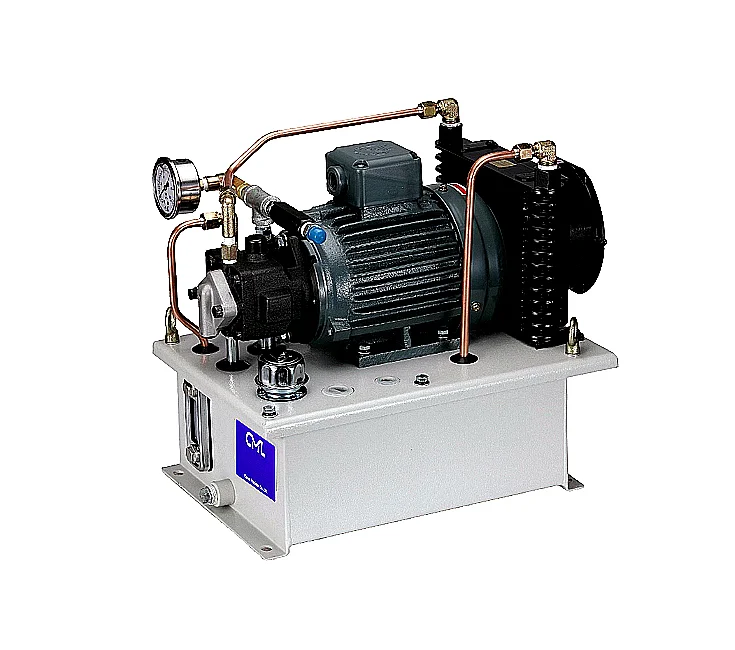

Cooling Circulation Power

Hot-Selling ProductsStabilizes oil temp. (avg. -20%) while reducing tank size, oil use, and boosting processing accuracy and stability.

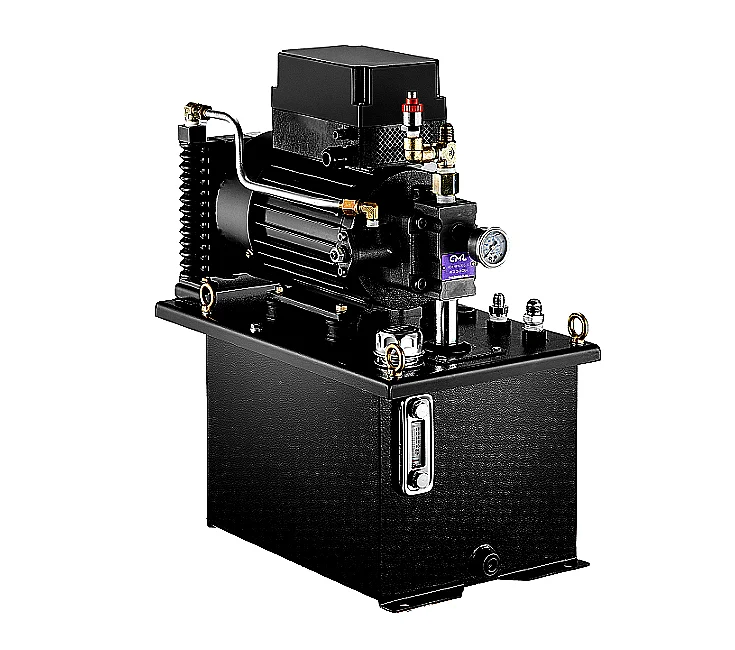

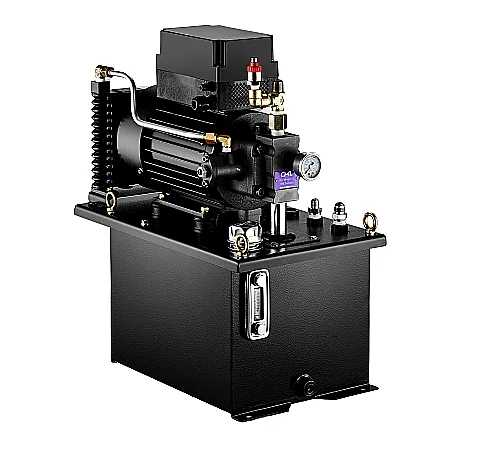

Energy-saving Hybrid Power Unit

Hot-Selling ProductsPrecise oil temp. (+/- 2.5°C of ambient) with 40-60% power & size reduction, and 6dB noise cut.

Orbital Hydraulic Motor

BMM, BMP, BMPHCompact, efficient, and powerful. Ideal for construction, injection molding, machine tools, metallurgy, and agriculture.

High-Pressure Diaphragm Pump

MPDWith up to 100 bar pressure, this pump combines piston, diaphragm & gear tech to reduce heat and extend service life.